Intel's priciest chip has 24 cores and sells for $8,898

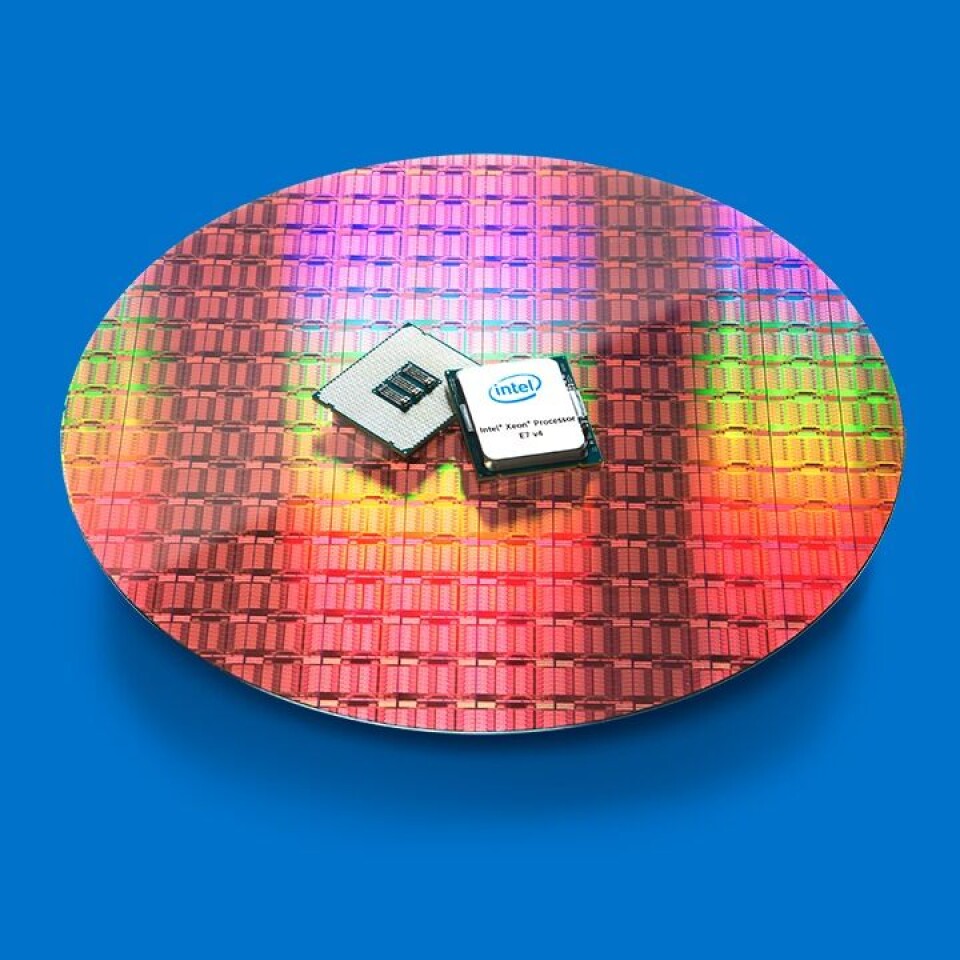

IDG NEWS SERVICE: Intel's Xeon E7-8894 v4 is a monster server chip with 24 cores, 60MB of cache and a maximum clock frequency of 3.4GHz.

No Intel chip is as expensive as the new Xeon E7-8894 v4 server processor.

The US$8,898 Xeon chip has massive horsepower with 24 cores, 60MB of cache and a maximum clock frequency of 3.4GHz. Intel said this is the company's fastest server chip, breaking enterprise application speed records.

The company's next expensive chip after the E7-8894 v4 is its other 24-core processor, the Xeon E7-8890 v4, which is priced at $7,174. The chips have similar features except for the base clock speed. The new chip starts at 2.4GHz compared to 2.2GHz for the less expensive chip.

The $8,898 chip even outprices Intel's fastest supercomputing chip, the Xeon Phi 7290F, which is priced at $6,401. It is also over four times more expensive than the costliest PC chip, the $1,723 Core i7-6950X for gaming desktops.

Some price competition could come from AMD, which is reentering the server market with Zen-based chips in the second quarter. Its initial server chips code-named Naples have up to 32 cores. AMD has not revealed the target market for Naples, but it could be cloud providers.

During an earnings call, AMD indicated Naples chips would be competitively priced, and downplayed its margins expectations. AMD is projecting Zen chips to be high performance, but the company is looking for volume shipments and may not participate in the low-volume market of servers with more than eight sockets.

The Xeon E7-8894 v4, which is based on the Broadwell architecture, is priced high for many reasons. It is targeted at fault tolerant servers used by financial or retail companies which need highly reliable systems for transactions and fraud detection. These companies could lose hundreds of millions of dollars if a server crashed.

The new chip also has features not found in regular PC or server chips, like error correction and RAS (reliability, availability and serviceability), which can diagnose and troubleshoot issues without crashing servers. The chips also have high levels of I/O and networking integration.

Right now server buyers don't have bargaining power with Intel, which has more than a 90 percent market share in server chips. Intel charges a hefty premium for the performance and adjacent technologies it bundles, including server and networking gear.

The E7 v4 chips aren't high in volume shipments, and are made in smaller batches. But these are highly profitable chips and fuel revenue for Intel, which is now relying more on data center equipment than PCs for growth in the future.

Server chips already have a high markup, but average prices have been going up in recent years and will continue to rise, said Diane Bryant, executive vice president and general manager of the Data Center Group for Intel, during a speech at a investor day meeting in Santa Clara, California, on Thursday.

Prices have been going up due to new applications like machine learning and analytics and the growth of business cloud services, Bryant said.

"Because they see value in our high-end products, they are buying up the stack," Bryant said.

But server purchases have stalled after years of growth, and Bryant projected a 5 percent decline in server CPU shipments going into 2021. The company isn't expecting to grow from server CPU shipments, but from adjacent product shipments to telecom and cloud providers.

Competition from AMD has been worked into the server chip price and shipment projections, Bryant said.

Intel plans more potentially powerful and expensive chips this year. The company will ship a deep learning chip called Knights Mill and a separate chip called Lake Crest that will integrate Xeon with a deep-learning chip based on technology acquired from Nervana Systems.